The majority of entrepreneurs and owners of small-to-medium-sized businesses have found themselves in a situation where they are being hindered from every direction by insane amounts of red tape and requirements that prevent them from taking out much-needed loans.

To put it simply, banks are sometimes just too slow or demanding for budding entrepreneurs who need money for emergencies. These emergencies are often the turning point in a young company’s life and if their owners cannot get the money quickly enough, these businesses usually fail. Luckily, there are still companies like Sunwise Capital out there that are ready and willing to help out business owners in such situations. In this Sunwise Capital review, we will go over all the reasons why doing business with this company is a good idea.

Sunwise Capital was founded in 2005 in order to help solve a major issue that thousands of small businesses were facing: getting money. In other words, the company was unable to access the funds they needed to continue to grow. What they did was that they combined their passion with the latest technology available to evaluate businesses based on their actual performance instead of personal credit.

According to their website, they understood the challenges of building a business through equity, debt, off-balance sheet financing, maintaining cash flow, making payroll, and business expansion, as well as inventory/equipment management. This has later enabled them to say “yes” faster and more often than traditional lenders. They have allowed business owners to spend their time properly – growing their business instead of begging for means to finance their ideas.

LOAN FEATURES

Business owners face both challenges and opportunities every day. What’s more, they are always required to have access to capital. Sunwise Capital specializes in handing out small business loans to help people overcome the challenges unique to their businesses, as well as to take advantage of important time-sensitive opportunities.

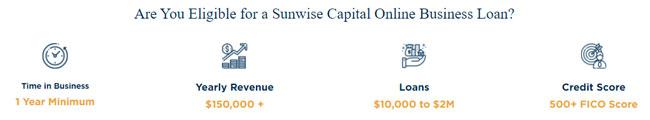

Sunwise Capital offers loans that can be used to remodel your business, advertise your products or services, purchase inventory and equipment, and improve your small business in any way you see fit. They even offer small business loans for people who just need an influx of capital to boost their cash flow. There are both fixed and flexible repayment options and you are allowed to customize your funding to meet your business’ cash flow model. With their funding products, you can access between $10,000 and $2,000,000. If your loan is approved, you can be sure you’ll have it in the next 24 hours.

LOAN APPLICATION INFORMATION

Most loan companies rely on simple application forms, as this way of doing business is one of their biggest strengths. The average number of documents required to apply for a bank credit is 23. There are also various unknown costs that can add up to several thousand dollars. If you opt for Sunwise Capital, however, you only need to complete and sign the application and prepare 3 months’ worth of bank statements and the first page of your last business tax return.

In order to be eligible for their loan, you have to have a running business for at least a year and an annual revenue of at least $200,000 per year. What particularly impressed us while researching for this Sunwise Capital review is that they provide loans for more than 725 industries, including restaurants, retailers, and other service providers. Sunwise Capital operates in all 50 states, so you don’t have to worry about your location if you want to apply for their loan.

REPAYMENT TERMS

You will repay your loan through ACH withdrawals directly from your bank or credit card account. Once you sign up, you will repay them automatically. You will either have to pay them on a monthly or weekly basis, depending on your agreement with the company.

As for the interest rates and repayment deadlines, they are determined through individual loan approvals, meaning they will be different for each client. On the other hand, you will never be asked to pay application fees, success fees, back-end fees or origination fees.

SUMMARY

Sunwise Capital is a serious player on the loan market. If you’re a small business owner and have less than perfect credit or insufficient collateral, they could very well be your future financing source.