= = = = Important Update = = = =

Signature Loan has been acquired by Personal Loans. You can read our Top 9 Loan Companies Personal Loans Review here.

= = = = Important Update = = = =

Signature Loan is an online service owned and operated by Arrow Eagle LLC. and partnered with numerous lenders and lending partners. Arrow Eagle LLC. is a company entirely owned by members of the Ute Indian Tribe and pursuant to their sovereign laws. Third party lenders have been known to partner with Indian Tribes in order to circumvent state regulations and we think this is the case here as well. This is not an inherent signal of any underhanded business ventures, but we recommend caution nonetheless.

Recognized Native American Tribes enjoy sovereign immunity, which means that the tribal courts of the Ute Ouray Reservation of Utah will have sole jurisdiction for litigations arising from your use of the Signature Loan site or any orders you made. Keep reading our Signature Loan review to find out if this company can meet your specific needs.

- Wide range of loan amounts (1k$ to 35k$)

- Quick approval

- Various repayment terms available

- A wide variety of lenders and lending partners

- No prepayment penalties

- Limited litigation possibilities

- High interest rates

How Signature Loan Works

Signature loans are online installment loans ranging between 1,000$ and 35,000$. The funds can be used for a variety of purposes, from home improvements to family vacations.

In order to be eligible for Signature Loan services, you need to at least 18 years old, be either a permanent US resident or a citizen, possess an email address, a checking account, and a valid phone number. If you meet all of these conditions, Signature Loan will search its network of lending partners and lenders and pick the best options for you.

Note that poor credit score usually won’t hinder your ability to get a loan with this company, but every lender will perform a credit check. If you miss out on a payment, this will affect your credit score in a negative way. So, lenders partnered with Signature Loan won’t pay too much attention to your credit score, but missed payments will cause trouble. This substantiates our claims from the beginning of this Signature Loan review.

If you satisfy all the requirements, you can proceed to provide relevant data and apply for the loan. The company will do the research and suggest the best lending options for your particular financial difficulty.

Application Process

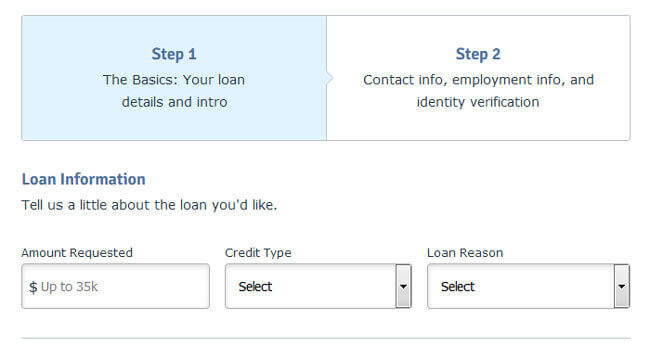

Application with Signature Loan is very simple and can be done in just a couple of minutes. You’re expected to provide the following information:

- Loan Information – Here, you will be prompted to provide the desired amount for your loan, choose the credit type, and explain the reason you’re applying for the loan.

- Introduction – In this section, you should provide your full name and birthday. You’ll also have to respond whether you’re on active military duty or not.

The company states that they require this information solely in order to provide better service and connect you to the best lenders for your particular needs.

The next step requires you to submit even more info:

- Contact information – Email address, phone number, contact time, address, zip code, state, city, length at address, and more.

- Employment information – Income source, time employed, employer name, employer’s phone, and monthly gross income.

- Identity and bank information – State ID or driver’s license, issuing date, social security number, and bank account type.

- Finally, you’ll be asked to agree to their privacy policy and E-Consent and provide your mobile phone number in case you’re interested in receiving a secure link to your loan request.

Repayment Terms

Repayment can be performed either once every two weeks or monthly, depending on your chosen lender’s terms or your personal preferences. Many lenders offered by Signature Loan will automatically withdraw funds from your bank account on the agreed date. With automatic payments, you don’t have to worry about missing one as long as there are enough funds on your account to cover them.

Be sure to understand the effects of late payments on your loan. It’s very likely that your late payments will incur extra charges. If you extend the loan, the original finance charges still need to be paid on the original due date. Only then will your principal loan be deferred with extra charges. If you intend to deviate from the original payment plan, it is best to contact your lender and establish a new payment arrangement.

Missing payments will affect your positive payment record and probably incur some negative repercussions depending on the lender in question. Every lender has its own policy regarding late payments, but they’ll all most likely file collection procedures against you and deny further potential services.

With some of the lenders, it might be possible to roll over payments, which can also affect your credit score. Rolled-over payments will have the same interest rate as your missed payments.

Each affiliate lender has its own renewal policy, but they can all be sorted into two different categories:

- Unlimited renewals

- Automatic/borrower initiated renewals

If you miss a payment without contacting your lender, they will most likely subject your loan to collection. If you ignore them, they will probably use an outside agency for this purpose. The specifics of this action will differ from one lender to the next, so it’s very important that you understand the policies of your chosen provider.

Rates & Fees

Here is a general range of terms offered by Signature Loan affiliated lenders:

- Loan amount – 1,000$ – 35,000$

- Lending period – 6 – 60 months

- Payment frequency – Once or twice a month

- Interest rates – The website states that the average APRs range between 5.90% and 35.75%

- Prepayment penalty – None

- If you repay your loan before its due date, you’ll only have to pay interest for the outstanding loan period

Bottom Line

As seen in our Signature Loan review, this loan company offers decent services with a wide variety of lenders and lending partners available. They are a tribal lending company, but we haven’t seen any strong indicators of underhanded actions and practices.