Launched and operated by On the Barrelhead, LLC (OTB), PersonalLoanPro is a BBB-accredited business that strives to inform its clients about the latest loan products and reputable lenders and familiarize them with the lending marketplace in general.

It will connect you with some of the biggest names in the lending industry, but it is NOT a lender itself. Furthermore, its service will not cost you a single dollar; the company gets paid by the lenders themselves after they have established a successful business relationship with you.

Keep reading this honest PersonalLoanPro review to learn more about this particular company and its business model and how it can help you solve any financial difficulties you might be experiencing at the moment.

- Simple application process

- Quick approval

- Flexible terms

- Loan does not affect your credit score

- BBB-accredited business

- Solid privacy policy

- Subpar FAQ section on the official website

How PersonalLoanPro Works

PersonalLoanPro implements a rather simple and straightforward business model in order to provide its clients with a personal (and personalized) loan as soon as possible. People usually take personal loans either to make a purchase when they are out of cash or refinance an existing debt obligation at a lower rate. As you might imagine, both scenarios can be quite time-sensitive, which is why PersonalLoanPro’s service is so popular.

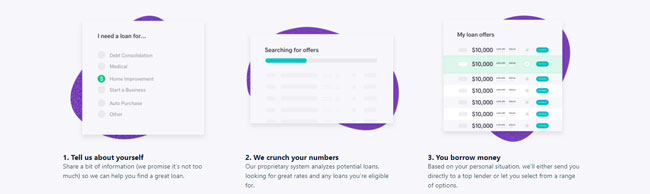

With that in mind, the company’s modus operandi includes the following steps:

- First of all, you will be prompted to provide some essential information to allow the staff to gauge your personal situation and find an adequate lending solution.

- Your data will be analyzed by the company’s proprietary system in order to match your credit eligibility with an optimal loan and the lowest rate possible.

- Finally, based on your situation, the company with either provide you with a range of options or send you to one of its partners directly.

Note that your credit history and credit score WILL be taken into consideration when determining your loan size and applicable rates. On the other hand, taking a personal loan through PersonalLoanPro will NOT affect your credit score since the company uses a soft credit pull to see what type of loan you can be approved for. In other words, a soft credit pull is not recorded on your credit file, which means it cannot impact your score in any way.

Application Process

During the application process, you will be prompted to provide the following information:

- Purpose of the loan – Debt consolidation, medical, home improvement, credit card consolidation, auto/motorcycle purchase, major purchase, start a business, open a new location, education, vacation, wedding expenses, other;

- How much cash would you like to borrow – $1,000 – $50,000;

- Credit score estimation – Poor – <640; fair – 640 – 680; good – 680 – 720; excellent – 720+;

- Employment status – Full-time, part-time, self-employed, unemployed, military, retired, other;

- Annual income + pay frequency – Every week, every two weeks, every month, other;

- Residence type – Rented, own, other;

- Zip code, street address, email, first/last name, date of birth, and phone number;

- Whether you are in the military/veteran;

- Social security number.

After you have entered the required information, all you have to do is click the “Get my rate” button and wait for the system to give you an estimation based on your credit score and other relevant factors.

Repayment Terms

As we already mentioned in this PersonalLoanPro review, the company itself is not a lender and all it does is connect you with some of its partners based on your credit score and other relevant information. Some of its partners include Upgrade, SoFi, Prosper, and LendingClub.

Having said that, the company is quite flexible when it comes to the needs of its clients and it will negotiate numerous repayment reliefs on your behalf, including flexible terms, lower monthly payments, and more. You will also have an opportunity to suggest your ideal payment plan and the staff will give its best to make it happen as long as your credit score meets the requirements.

Rates & Fees

With loans offered by PersonalLoanPro’s partners, APRs start at 4.99% while the maximum has not been specified. As we already stated, PersonalLoanPro does not charge you anything for its service and collects its fees from the lenders themselves. As far as the rates and fees of its partners are concerned, you can check their individual websites once the algorithm identifies the best lending option(s) for you.

Bottom Line

PersonalLoanPro is a well-known company that acts as a middleman between reputable lenders and people in need of loans between $1,000 and $50,000. It currently boasts more than 1.7 million customers and over 13 billion dollars in personal loans requested.

The company is BBB-accredited, features a solid privacy policy, and takes only 1-2 business days to transfer the money to your account if you are approved for a loan. The terms are negotiated to benefit the client as much as possible and you can solve your financial difficulties in peace knowing these personal loans will not affect your credit score in any way.