= = = = = Important Update = = = =

As of late 2019 Performance Auto Loans is officially out of business. We do not have any additional information about this at the moment. If you’re looking for a similar company check out our comprehensive review of Check Into Cash. They offer Payday Loans, Installment Loans and Title Loans.

= = = = = Important Update = = = =

Performance Auto Loans is a California-based automotive financial services company. It provides sub-prime personal and automotive loans to people who otherwise might not be able to secure a loan. It’s no secret that millions of people have bad credit or even no credit and Performance Auto Loans doesn’t let either situation mean an automatic loan rejection for applicants. Instead, the company provides countless people with the opportunity to affordably purchase a used vehicle while building or even repairing their credit at the same time.

LOAN FEATURES

Getting approved for a vehicle loan can often be a difficult process but that’s not the case with Performance Auto Loans. For the purpose of this Performance Auto Loans review, we have tested the service and we are happy to say that the application process takes just a few minutes to complete online or by phone and there are no application fees.

In addition to issuing car loans, Performance Auto Loans also provides title loans to those who are in need of quick cash. Borrowers can get a minimum loan of $2,501 and a maximum loan of $20,000 using the title for their paid-off automobile as collateral. It’s even possible to get same day funding if you’re in need of cash fast. Title loans are a great option if you’ve got bad credit or no credit; that’s because the loan you qualify for is based on the value of your vehicle, not the state of your credit history!

As an added bonus to those who choose Performance Auto Loans for their vehicle loans, all auto loans issued through Performance Auto Loans automatically include GAP insurance. So, if your vehicle is stolen and unrecoverable or involved in an accident where it’s written off as a total loss, GAP insurance covers the difference between what your automobile insurance covers and what you owe on your loan, up to $5,000 of your remaining balance. The company also offers GPS anti-theft devices to all of its customers in order to make the recovery of your vehicle possible should it ever be stolen. Even better, many auto insurance companies will provide a discount on your insurance premium for having an anti-theft device in your car.

LOAN APPLICATION INFORMATION

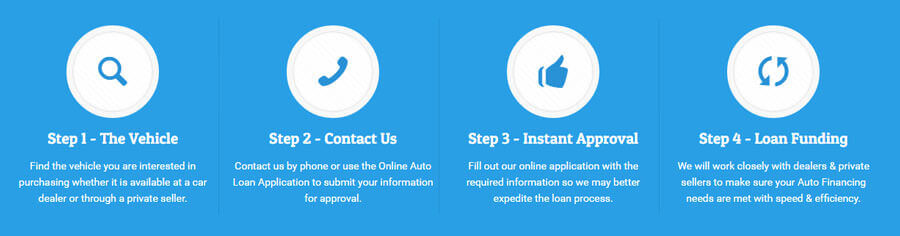

Whether you’re looking at purchasing a used car or refinancing your current vehicle to reduce your monthly payment, Performance Auto Loans can help you. It all starts with their online loan application or, if you prefer, you can contact them by phone to apply. Either way, the process is quick and painless.

The loan process includes the review of such factors as your credit and employment records and income and expenses to help you make an informed decision about a loan that fits your needs and budget. The maximum auto loan amount is $20,000. If you happen to be looking to buy a used vehicle that costs more than that, Performance Auto Loans requires that you cover the difference in the form of a down payment.

If you’re applying for a title loan, the application process is the same but the background criteria are different since employment and credit history aren’t factors. In most cases, you can get a decision on your title loan instantly and receive your cash within 24-48 hours.

REPAYMENT TERMS

The maximum repayment period that Performance Auto Loans offers is 48 months. Payments are monthly and you can pay off your loan in full at any time with no penalties. You can even make additional payments above and beyond your monthly payment if you like, again with no penalties. For title loans, the repayment period varies from 3-6 month repayment terms to 24-48 months.

Making your actual payments couldn’t be easier. In today’s hyper-connected world, it’s possible for you to make your monthly Performance Auto Loans payment from virtually anywhere: online, by phone or in person. In-person payments can be made at any 7-11 or Family Dollar store locations using the company’s PayNearMe service. Even better is the fact that you can pay via cash, check, eCheck, debit or credit card regardless of where you make your payment.

SUMMARY

At the end of this Performance Auto Loans review, we will reiterate that this company offers good loan options for someone who’s in the market for a used car but has a poor, limited or no credit rating. Their easy application and decision-making processes mean less paperwork and waiting time for approval than at other ‘traditional’ brick-and-mortar lenders. With a professional team that’s dedicated to helping the consumer, Performance Auto Loans can get you the cash you need when you need it.