Getting the best loan possible with a bad credit rating means you need to find a lender that is as transparent as air about rates and fees, flexible on terms, and willing to view you as more than just a means of earning cash. It also means that you need to avoid predatory lenders and common scams that will lure you into a trap with false promises.

Sure, a loan may not be able to solve all your problems. However, when used properly, a loan can be the tool you need to get a handle on your finances, find some breathing room in your budget or improve your credit. As you will see in our CAN Capital review, this is a reputable loan company that can help you with all these things.

CAN Capital has been helping small and medium-sized businesses thrive since 1998. They feature cutting-edge technology, quick application and approval processes, customer-focused delivery, and great service that keeps people at the forefront of the small business funding industry. CAN Capital has been the market share leader in alternative small business finance since 2013.

CEO of CAN Capital Daniel DeMeo has held this position since early 2013, after joining the company as CFO in 2010. During his tenure, he has led CAN Capital to continued growth and profitability, as the company is constantly strengthening its leading position in the financial technology industry.

LOAN FEATURES

Since they are one of the best small business loan companies on the market, you won’t be surprised to hear that they specialize in small business loans and that they offer a couple of different variants of business loans.

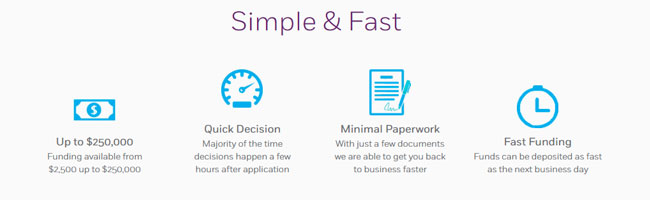

If you’re operating a single-location business, their standard business loan can give you up to $150,000 whereas you can get up to $250,000 for multi-location businesses. This loan can cover assets such as inventory, tools, equipment, vehicles or technology. It can also be used for various improvements, like business expansion, renovations, and general upgrades and development.

The TrakLoan option is a flexible, “cash-flow friendly” way to access small business capital. Instead of writing a huge check once per month, a flat percentage of your business’ credit and debit card sales are automatically remitted on a daily basis.

If you’re operating a serious business that makes a lot of money per year (we’re talking seven digits) and you’re looking to expand, CAN Capital’s Installment Loan is their premier loan service, available only to a select group of highly successful businesses. It also has the lowest interest rate.

Finally, their Merchant Cash Advance method is basically a customizable plan – you get to choose pretty much everything, except, of course, the interest rate, which is calculated once all the other factors have been taken into account.

LOAN APPLICATION INFORMATION

As with many other loan companies, CAN Capital will require a lot of information about you before they actually give you the loan. This includes your name, surname, address, DoB, address, ZIP code, social security number, credit card number, everything.

Another thing you should pay close attention to is whether you are eligible for their loans, as they have different requirements for each and every single one of their categories. For instance, if you want the basic package, you only need a relatively stable business with a monthly gross revenue of $4,500 or more. However, if you want their installment loan, you have to run a business that’s been active for at least 7 years and has $350,000 or more in annual sales.

REPAYMENT TERMS

Logically, since their offers vary from category to category, their repayment terms are also quite different. If you opt for their basic loan, you have anywhere from 4 to 24 months to pay it back. Their TrakLoan is paid back daily while their installment loan has a maximum deadline of 4 years.

SUMMARY

CAN Capital is one of the best choices for everyone who wants to start or further develop their business. Their wide range of loan offers, as described in this CAN Capital review, will allow you to choose the one that best suits your needs. If you’re looking for a serious company that doesn’t mess around with their services or their customers, CAN Capital is just what you need.