My Auto Loan, also known as Horizon Digital Finance LLC, is a privately-held, Internet-based financing company that helps customers take control of both the research and the financing process when purchasing automobiles and motorcycles. They offer a wide range of products and services to retrieve information and find alternatives. They provide a secure and confidential process for their customers to receive up to four loans while helping them find matching lenders. To satisfy the needs of their clients, they use the Preferred Placement evaluation. My Auto Loan is a leader in the online financing business and provides innovative, technology-driven solutions and resources that excite their customers. They are focused on lifestyle products and are dedicated to providing the best services in the industry, which is what inspired us to create this My Auto Loan review.

LOAN FEATURES

My Auto Loan offers different types of auto loans, such as new car loans, used car loans for people who want to purchase a vehicle from a dealer, and private party car loans. Their services also include refinancing existing loans and buying out current vehicle leases. There are only minor differences between these types of loans. Basically, it all depends on the client and what suits their needs. A new car loan is one of the most common financing options.

Used car loans are pretty much the same as new car loans. The only difference is that clients purchase cars from dealers, having the chance to negotiate the right price for the right vehicle. If a customer has an existing monthly loan and wants to free up cash, they can refinance it through My Auto Loan. Customers can also receive a loan to pay out the outstanding amount left on a vehicle lease in order to either change vehicles or buy one. Finally, there are also private party loans, which are useful for people buying a vehicle from another person. My Auto Loan can help secure the money before connecting the buyer and the seller.

LOAN APPLICATION INFORMATION

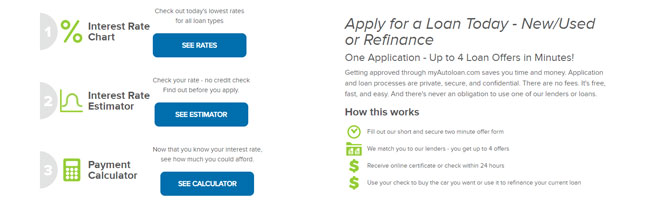

To apply for a car loan, the customer first needs to decide what loan would best suit them: a new car loan, used car loan, refinancing, buying out a vehicle lease or a private party car loan. Each type of loan has different regulations and there are various steps a customer needs to take to prove that they have a steady income. They also have to provide their tax return or bank statements, proof of identity, and other personal information.

REPAYMENT TERMS

My Auto Loan helps clients receive up to four loans through a multitude of lenders that they are connected to. The repayment plan depends on the lender that finances the vehicle loan. The customer will have to repay the loan in accordance with the agreement or contract with the lender they chose. Since this company offers low interest rates and fees, finding the right loan and repaying it should not be an issue.

SUMMARY

As you could see in this My Auto Loan review, this company is hell-bent on helping their customers purchase their dream vehicle. With the many choices that this loan company has to offer, there is a great chance that each and every customer will receive what they came for. Moreover, finding the right lender will help them finance or refinance the new or used vehicle of their choice. When getting an auto loan, it is best to inform yourself about the lowest rates and the amount of money that you can receive. My Auto Loan will help you make the right decision that will suit your specific needs.