Blue Sky Financial strives to arrange and secure an optimal car loan selection, providing its customers with the expedient service they deserve. Founded in 2004, this auto finance company has had their fair share of experience when it comes to car lending. Moreover, they have given an array of auto loan opportunities to a number of people with credit difficulties. They specialize in this particular field and aim to meet your specific financial needs, allowing you to get pre-approved before going to a car dealership. They are available 24 hours a day and will gladly help you stay up-to-date with the most convenient auto loan options thanks to their unique set of online research tools. Continue reading our Blue Sky Financial review for more information!

LOAN FEATURES

You have several loan options at your disposal if you register at BlueSky – you can get new or used auto loans, bad credit auto loans, and cash and personal loans or you can refinance an auto loan. Regardless of your current credit issues or past financial problems, you can get into the driver’s seat in less than 24 hours if you’re lucky! Don’t let your bad credit history stop you from getting what you want. Furthermore, if you’re looking for some emergency cash, don’t worry – BlueSky’s got you covered with their vast network of potential lenders that can approve a cash loan of up to $2,500. You can also start saving your money with their amazing refinancing loan options, lower your interest rates, reduce your expenses, and start investing in your future properly. You can hardly find a place that provides a better all-encompassing loan service than this one!

LOAN APPLICATION INFORMATION

Complete the auto loan application of your choice and let their team of professionals do the rest. You can access their website and view the status of your application at Loan Status Page. Purchase your next car with as little hassle as possible, get pre-approved, sit back, and enjoy the ride. You will get an e-check once your request is processed and approved. This is very convenient since you can do all of this from the comfort of your home. In addition, you can be sure that your private information is well stored and secure, as Blue Sky Financial goes out of its way to protect their clients’ privacy with their cutting-edge online encryption system. Everything is strictly confidential and you will be glad to know that they are also well connected with the Better Business Bureau where they have maintained a clean record for years.

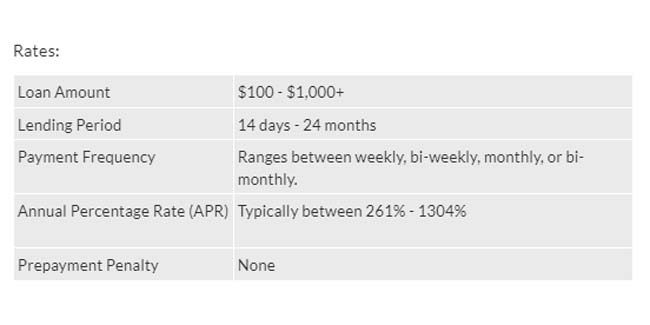

REPAYMENT TERMS

Interest rates vary depending on a few different factors, such as your car loan amount, your credit report information, and the type of vehicle you opt for. Once you apply, you will be notified about your specific interest rate, monthly payment, and other repayment terms which you may accept or decline. This means you are under no obligation whatsoever to accept the offer. However, as we found out while researching for this Blue Sky Financial review, the company’s agents will do everything they can to accommodate your specific needs.

What’s more, you may even be able to get auto financing with no money down if you have a good credit score. They don’t charge you to apply, so get registered and see how good of a loan you can get!

SUMMARY

We can conclude this Blue Sky Financial review by saying that the company truly wants you to fully understand the terms under which you are getting your car loan so that there are no hidden costs or surprises. Their principal goal is to help you negotiate the best deal! Your bad credit history doesn’t have to put you in dire straits – get the best out of your situation and set some money aside, as you’ll be saving both money and time with Blue Sky Financial. This auto loan company will help you get the funds as easily and speedily as possible. With their extensive knowledge center and car buying tips, you will get all the info you need. Decide on the type of loan and let them walk you through the hassle-free application process. It’s not every day that you find this kind of service!